- #Noi calculation spreadsheet how to#

- #Noi calculation spreadsheet plus#

- #Noi calculation spreadsheet professional#

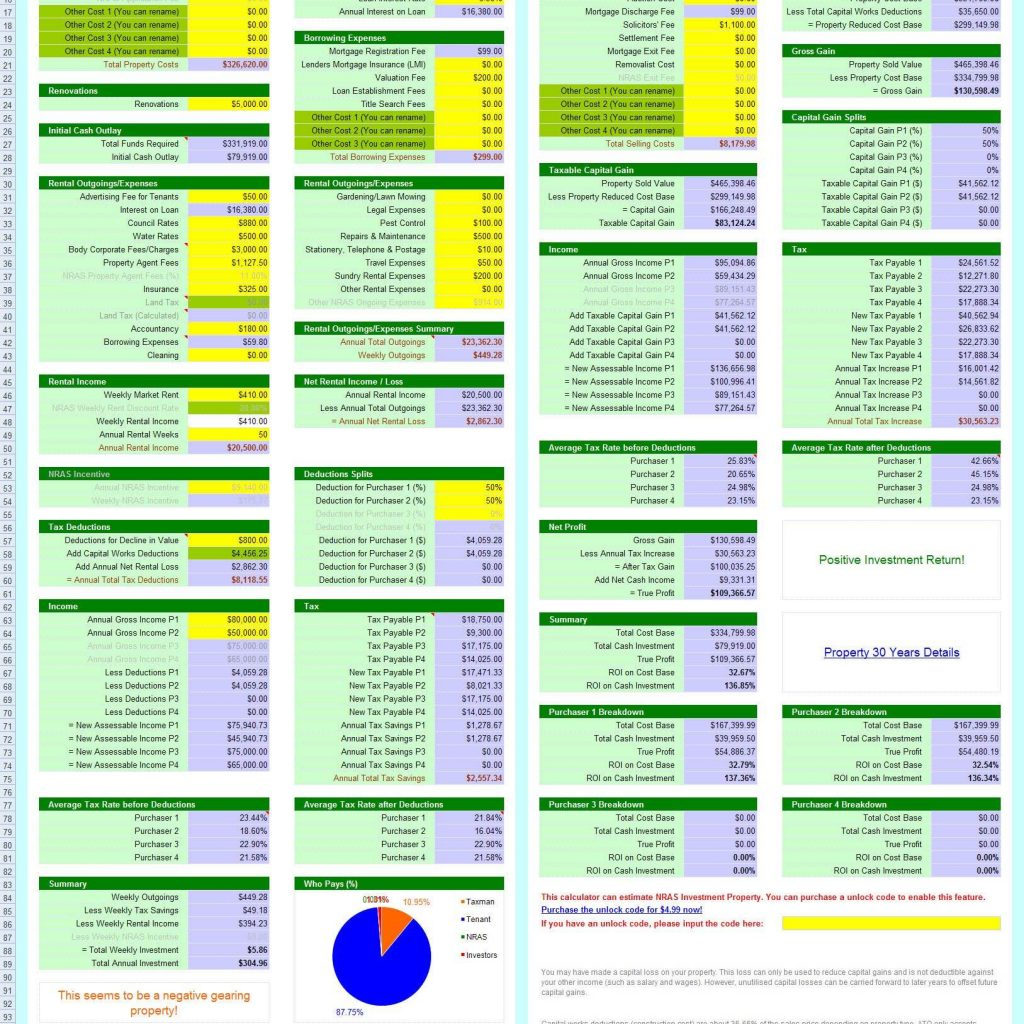

We’ll use a small four-unit multifamily property with the following income and expenses components: Debt service and mortgage interest expenseĮxample of Calculating NOI How NOI works in real life.The NOI calculation excludes expenses used to reduce taxable income such as depreciation and one-time capital expenses (CapEx) such as replacing a heating and air conditioning system. Now that you understand the inputs into the NOI formula, it’s time to put all your numbers into Hemlane’s interactive NOI calculator. Net operating income is the final result after subtracting operating expenses from gross operating income.

#Noi calculation spreadsheet professional#

Typical operating expenses include marketing, leasing, and property management fees, routine repairs and maintenance, property taxes and insurance, utilities, and professional service fees directly related to operating the property. Operating expenses are the costs of operating the property so that the estimated rents are collected.

#Noi calculation spreadsheet plus#

Gross operating income is the sum of the effective rental income from tenant rents plus other miscellaneous income generated by the rental property. Other incomeĭepending on the type of property, other miscellaneous income generated could include late rent payment fees, pet fees, parking, laundry and vending, and storage fees. Effective rental incomeĮffective rental income is the rental income a property owner can expect to collect after taking into account losses from vacancy and credit losses. Vacancy and credit loss (bad debt) considers factors such as rental income lost due to vacant property between tenant turns, and tenants defaulting on their lease payments. If the property is vacant investors can use the fair market rent for similar properties in the immediate area. Potential rental income (PRI) assumes the property is fully occupied 100% of the time and that the tenant always pays their rent in full. To calculate the net operating income you’ll need to know the property’s potential rental income, estimated vacancy and credit losses, miscellaneous income, and normal operating expenses.

#Noi calculation spreadsheet how to#

In this article we’ll explain how the NOI real estate formula works, some potential drawbacks of NOI to be aware of, and how to use NOI in other real estate calculations to quickly decide whether or not a property is worth a detailed look. One of the best ways to quickly understand if a property makes investment sense, is the net operating income (NOI) formula. In the hot real estate markets, investors who take too long analyzing a potential deal can lose the property to another buyer able to act fast. In short, it’s harder to find good investment opportunities. Days on market are at all-time lows, prices are increasing, and supply is getting lower due in part to rising material costs. Today there’s more demand for good investment real estate than there is supply.

0 kommentar(er)

0 kommentar(er)